- CASH FLOW STATEMENT ACCOUNTS HOW TO

- CASH FLOW STATEMENT ACCOUNTS FREE

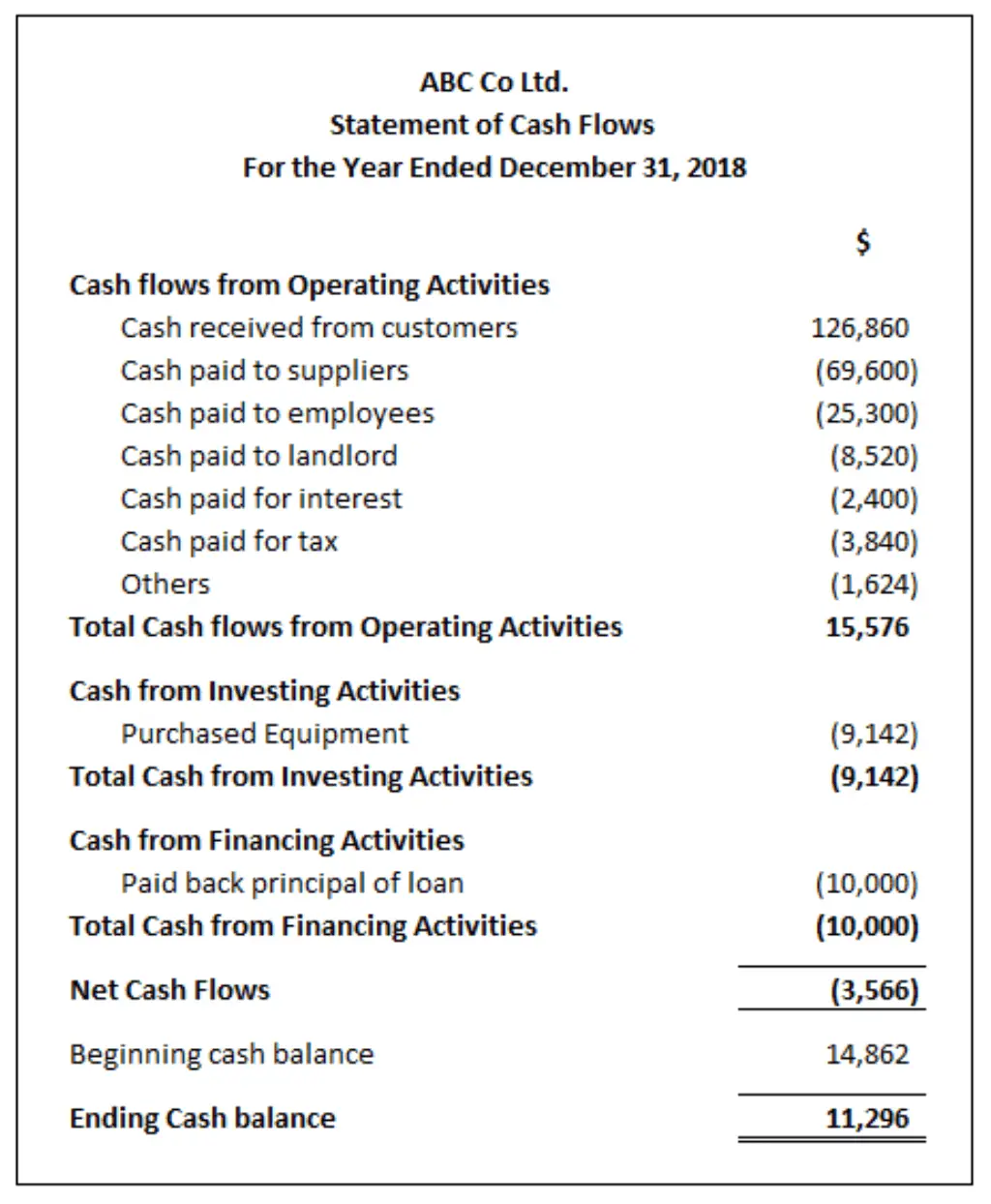

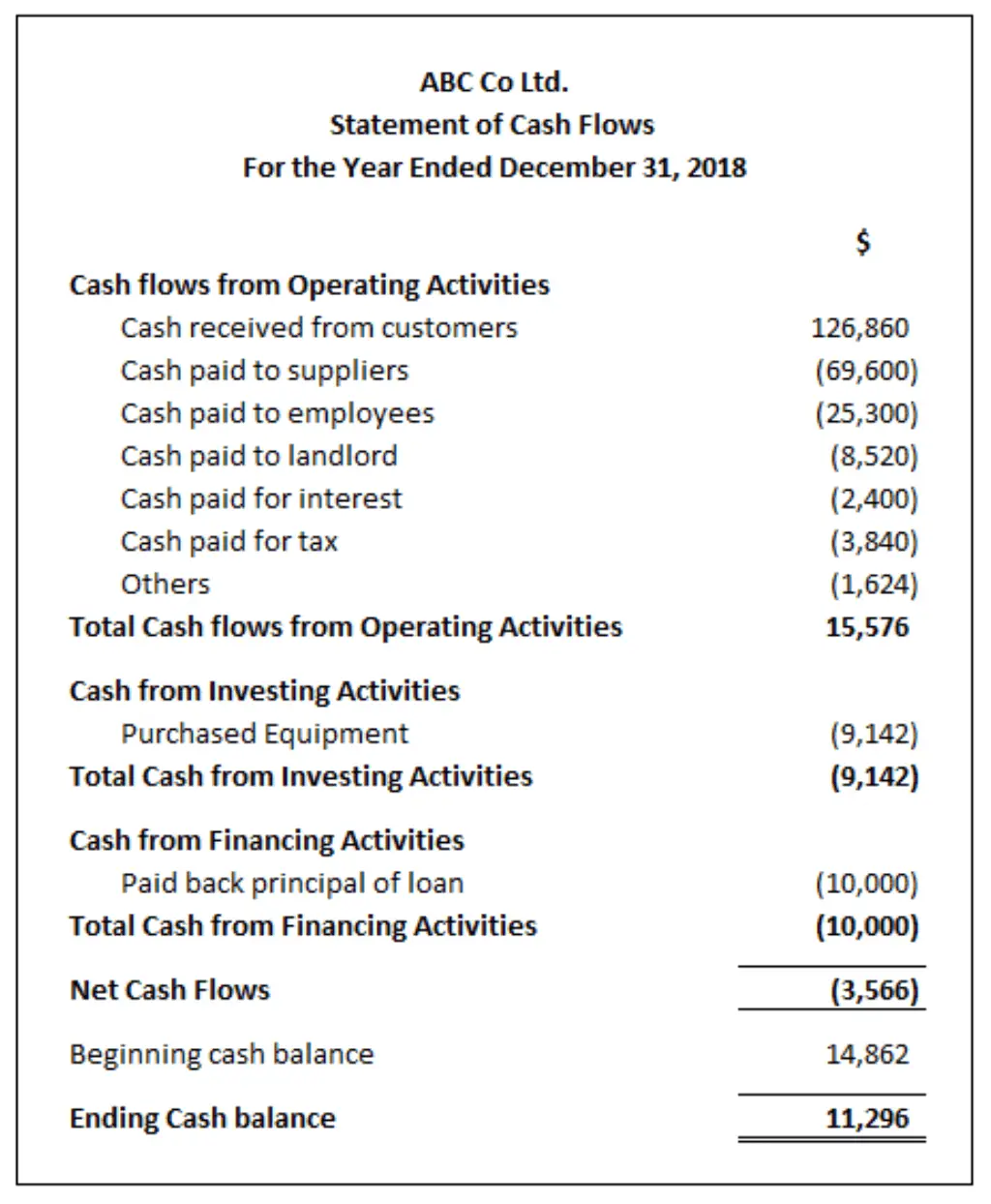

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified duration of time, known as the accounting period. Related: Financial Terminology: 20 Financial Terms to Know 3.

CASH FLOW STATEMENT ACCOUNTS HOW TO

This article will teach you more about how to read an income statement. To determine financial trends: When are costs highest? When are they lowest?.To understand how well their company is doing: Is it profitable? How much money is spent to produce a product? Is there cash to invest back into the business?.EBITDA: Earnings before interest, taxes, depreciation, and amortizationĪccountants, investors, and other business professionals regularly review income statements:.Depreciation: The extent to which assets (for example, aging equipment) have lost value over time.Earnings per share (EPS): Division of net income by the total number of outstanding shares.Net income: Income before taxes less taxes.Income before taxes: Operating income less non-operating expenses.Operating income: Gross profit less operating expenses.

Costs of goods sold (COGS): The cost of component parts of what it takes to make whatever a business sells. Expenses: The amount of money a business spends. Revenue: The amount of money a business takes in. Income statements typically include the following information: The document is often shared as part of quarterly and annual reports, and shows financial trends, business activities (revenue and expenses), and comparisons over set periods. How to Read an Income StatementĪn income statement, also known as a profit and loss (P&L) statement, summarizes the cumulative impact of revenue, gain, expense, and loss transactions for a given period. This article will teach you more about how to read a balance sheet. This money belongs to the shareholders, who may be private owners or public investors.Īlone, the balance sheet doesn’t provide information on trends, which is why you need to examine other financial statements, including income and cash flow statements, to fully comprehend a company’s financial position. It’s the amount of money that would be left if all assets were sold and all liabilities paid. Owners’ equity refers to the net worth of a company. Liabilities refer to money a company owes to a debtor, such as outstanding payroll expenses, debt payments, rent and utility, bonds payable, and taxes. The balance sheet also provides information that can be leveraged to compute rates of return and evaluate capital structure, using the accounting equation: Assets = Liabilities + Owners’ Equity.Īssets are anything a company owns with quantifiable value. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders). It allows you to see what resources it has available and how they were financed as of a specific date. How to Read a Balance SheetĪ balance sheet conveys the “book value” of a company. The value of these documents lies in the story they tell when reviewed together. To understand a company’s financial position-both on its own and within its industry-you need to review and analyze several financial statements: balance sheets, income statements, cash flow statements, and annual reports.

Costs of goods sold (COGS): The cost of component parts of what it takes to make whatever a business sells. Expenses: The amount of money a business spends. Revenue: The amount of money a business takes in. Income statements typically include the following information: The document is often shared as part of quarterly and annual reports, and shows financial trends, business activities (revenue and expenses), and comparisons over set periods. How to Read an Income StatementĪn income statement, also known as a profit and loss (P&L) statement, summarizes the cumulative impact of revenue, gain, expense, and loss transactions for a given period. This article will teach you more about how to read a balance sheet. This money belongs to the shareholders, who may be private owners or public investors.Īlone, the balance sheet doesn’t provide information on trends, which is why you need to examine other financial statements, including income and cash flow statements, to fully comprehend a company’s financial position. It’s the amount of money that would be left if all assets were sold and all liabilities paid. Owners’ equity refers to the net worth of a company. Liabilities refer to money a company owes to a debtor, such as outstanding payroll expenses, debt payments, rent and utility, bonds payable, and taxes. The balance sheet also provides information that can be leveraged to compute rates of return and evaluate capital structure, using the accounting equation: Assets = Liabilities + Owners’ Equity.Īssets are anything a company owns with quantifiable value. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders). It allows you to see what resources it has available and how they were financed as of a specific date. How to Read a Balance SheetĪ balance sheet conveys the “book value” of a company. The value of these documents lies in the story they tell when reviewed together. To understand a company’s financial position-both on its own and within its industry-you need to review and analyze several financial statements: balance sheets, income statements, cash flow statements, and annual reports. CASH FLOW STATEMENT ACCOUNTS FREE

If you’re new to the world of financial statements, this guide can help you read and understand the information contained in them.įree E-Book: A Manager's Guide to Finance & AccountingĪccess your free e-book today. The effect is an obfuscation of critical information. While accountants and finance specialists are trained to read and understand these documents, many business professionals are not. Armed with this knowledge, investors can better identify promising opportunities while avoiding undue risk, and professionals of all levels can make more strategic business decisions.įinancial statements offer a window into the health of a company, which can be difficult to gauge using other means.

An ability to understand the financial health of a company is one of the most vital skills for aspiring investors, entrepreneurs, and managers to develop.

0 kommentar(er)

0 kommentar(er)